Coming into 2025 the S&P 500 had just two down years out of the past 15:

- 2010 +14.8%

- 2011 +2.1%

- 2012 +15.9%

- 2013 +32.2%

- 2014 +13.5%

- 2015 +1.4%

- 2016 +11.8%

- 2017 +21.6%

- 2018 -4.2%

- 2019 +31.2%

- 2020 +18.0%

- 2021 +28.5%

- 2022 -18.0%

- 2023 +26.1%

- 2024 +24.9%

We were all probably a little spoiled. Regardless of the reason for the recent swoon, we were due.

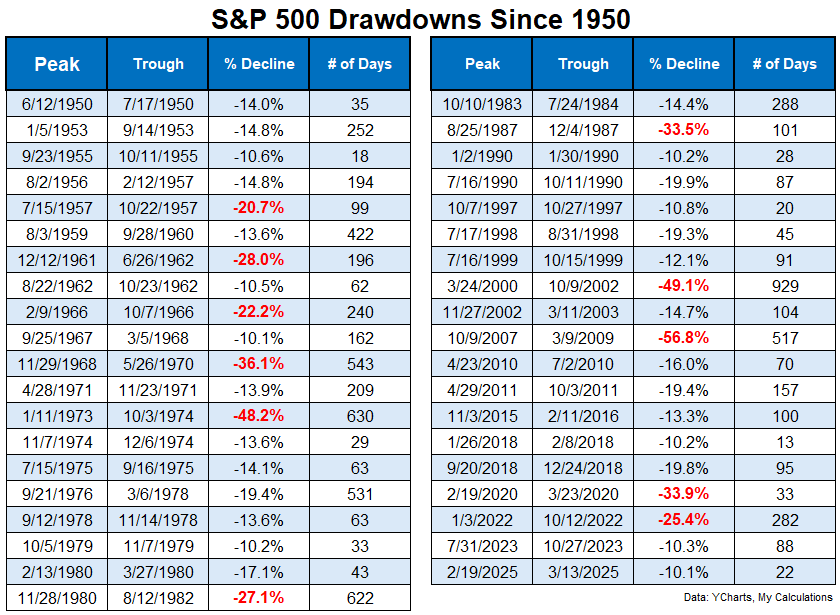

By my count this is the 39th double-digit downturn since 1950:

That’s basically one correction every other year on average.

Although the stock market was on a tear coming into this year, we’ve already had two bear markets this decade.

I don’t know if this will turn into another bear market but I’m not surprised that these big moves are happening more often.

Information travels at the speed of light. There are more algorithms, more leverage, more hedge funds, more high-frequency traders and more retail investors using options and such.

These days, recoveries and downturns seem to be happening faster than ever, but it’s not out of the ordinary to experience clusters of volatility like this.

It would be rare if this correction turned into a bear market, but this has happened before. There just hasn’t been a decade since the 1960s with three bear markets.

Before that you’d have to go back to World War II when there were four bear markets in five years from 1937 to 1942. Depending on how you define a bear market1 there were also a handful of bears in the front half of the 1930s.

Markets are far different today than they were back then in countless ways but human nature remains the constant across all market cycles.

As long as people are involved in the stock market, there will be emotional responses to the upside and the downside.

Get used to it.

Further Reading:

Signs of a Top

1It took a very long time to recover from the Great Depression crash but there were plenty of booms and bust along the way.

Publisher: Source link