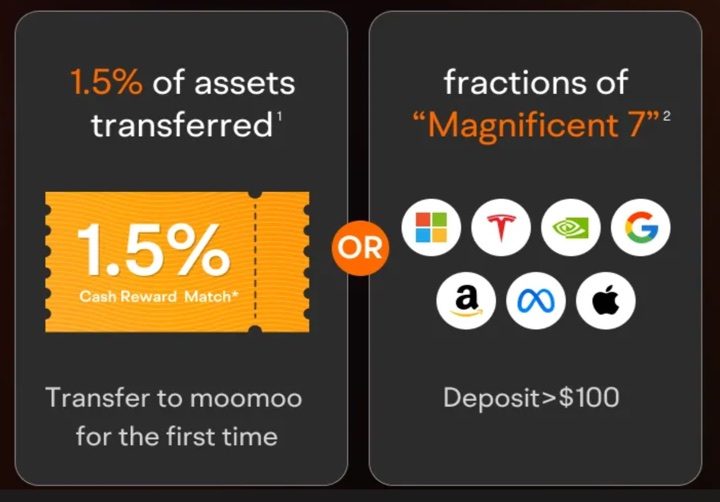

Update May 2024. New 1.5% asset transfer promo. Brokerage app Moomoo is offering a 1.5% bonus on assets transferred (up to a $300 bonus on $20,000 transferred). The minimum hold period is 90 days. Valid only for new customers. Full terms here.

(Side note: The alternative offer of “Magnificent 7” stocks is worth only ~$35 total, so I would skip that and wait for a better offer. For example, many of the post comments below were for a previous offer that included Tesla stock and was worth $300+.)

Your ACAT transfer must settle by 5/28/24 and must be coming from one of the following broker-dealers:

- Robinhood

- Webull

- TD Ameritrade (including ThinkorSwim)

- Interactive Brokers

- Fidelity

- E-Trade

- Cash App

- Charles Schwab

- Ally Invest

- Firstrade

- Merrill Lynch

Transfers from other broker-dealers are not eligible for this promotion. The value of the assets is determined at the time of settlement and not at the time you initiate the transfer.

Here is their definition of new customer:

1. HAVE opened a brokerage account, but have not made a deposit yet, and plan to make the first eligible ACATS transfer that settles before May 28, 2024, 23:59 PM ET.

2. HAVE NOT opened a brokerage account before April 01, 2024, 04:00 AM ET.

3. HAVE opened a brokerage account, but have not made a deposit yet, and plan to make the first deposit that settles before May 28, 2024, 23:59 PM ET.

Compared to the Robinhood 1% transfer bonus, this offer is 50% more money (1.5% vs. 1%) and the hold period is 85%+ shorter (90 days vs. 720 days). The main drawback is the cap at $300 bonus on $20,000 in asset transferred, but there are a few other wrinkles as well.

What Moomoo calls a “Cash Reward” is not a cash credit to your account like what Robinhood does; it works like a coupon that rebates a future stock trade. In my experience, it applied automatically but you to have to make a trade to claim it. In the past, I have chosen to just buy (and then sell) enough SGOV to trigger it (amount varies) if you don’t have other stock trades you plan to make.

Another potential drawback is that some people have noted that Moomoo does not participate in the ACAT system if you want to transfer out later. Instead, you must use the “DTC FOP” system and follow the directions here. All the major brokers I checked with can handle this, it’s just a bit different process. There is also a $75 transfer out fee (which you may seek to be rebated by your future broker).

* FOP (Free of Payment ) is a method to transfer US stocks between Moomoo Financial Inc. and another brokerage firm directly through The Depository Trust Company (DTC), without using the ACATS (Automated Customer Account Transfer Service) system.

If possible, you may instead consider transferring over enough assets to trigger the bonus without big unrealized gains, and then just sell after 90 days and withdraw the cash.

Publisher: Source link