When discussing fears about what our future will look like, it’s all a matter of perspective.

Americans close to retirement age have long worried about inflation, starting from the time they were young. Survivors of what’s known colloquially as The Great Inflation era from 1965 to 1982, the boomer generation knows what it feels like for prices to seemingly skyrocket overnight.

And while millennials and Gen Zers lose sleep over other futuristic concerns — namely homeownership, student loan repayment, and the existential dread of climate change — baby boomers are padding their nest eggs to prepare for what they fear will be a very expensive retirement.

Is Fear Driving Retirement Decisions?

In a recent poll, Personal Capital surveyed a national sampling of 772 retirees and near-retirees over the age of 40 and learned how many of those winding down in their careers are also planning for the worst.

One-third of respondents said they expect to need a bigger nest egg for retirement, and another third (36%) believe the pandemic has lowered their standard of living, either now or in the future.

The majority of respondents say their retirement plans are still on track and they expect to have enough to live on, but almost one-fourth (21%) say they will need to work longer and delay their retirement to make ends meet.

Interestingly, only 6% of those surveyed said they will have a better retirement than they’d anticipated — even though 68% said the net total of their investment portfolios increased in 2020. This contrast highlights the fact that, although most who took our survey performed well in the stock market last year, most don’t think it will be enough.

More than the rising cost of healthcare, survey respondents reported inflation as their number-one concern for the future. The vast majority (77%) expressed they were somewhat/very concerned about inflation, and a third (33%) said they were very concerned.

As for how boomers and near-retirees are handling this fear, the following percentages of respondents said they’d be taking these actions to boost their nest eggs in the coming years:

How near-retirees are preparing for inflation*†

- Cut spending: 62%

- Boost savings: 41%

- Take a part-time job to boost income: 32%

- Boost investments: 25%

- Delay retirement, work longer: 21%

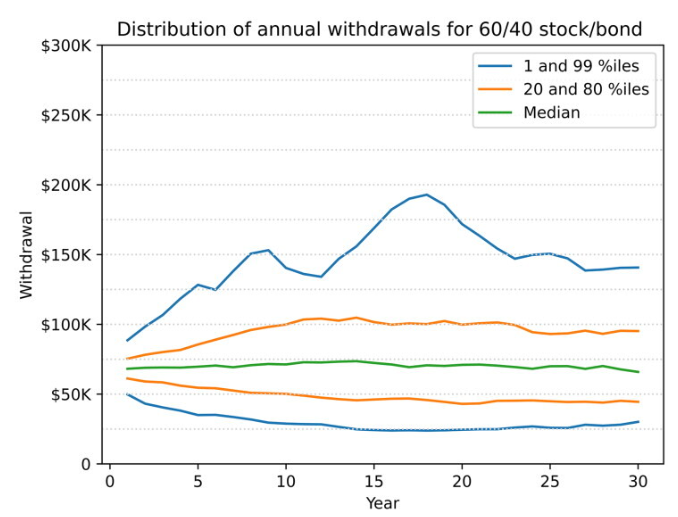

- Adopt a more conservative withdrawal rate from savings: 14%

Read More: Delaying Retirement: Comparing Retirement-Ready Investment Portfolios

Should Retirees and Baby Boomers Worry About Inflation?

It’s understandable for the generation who lived through the 1970s to fear the impacts of runaway inflation, which is when prices for goods and services keep accelerating well beyond the purchasing power of Americans’ earnings and savings.

While millennials have grappled with era-defining obstacles like record-level student loan debt and unpredictable job markets, it’s really the boomer generation who knows best what life is like when everyday goods like gasoline, toilet paper, and milk become too expensive for the average person to afford.

And they certainly don’t want to face the same fate in their retirement years.

But are such fears warranted? According to data from the Bureau of Labor Statistics, the Consumer Price Index increased just 0.3% in August after rising 0.5% in July. There’s been a steady creep from this time 12 months ago, overall increasing 5.3% before seasonal adjustment. But prices peaked in April 2021 and again in June 2021, and since then the runaway inflation effect seems to be slowing — or at least inconsistent.

Not all industries have been impacted the same, either.

The energy index is notably higher, a 2.0% increase due mainly to a 2.8% increase in gasoline. Meanwhile, the index for food rose just 0.4%, and everything else increased only 0.1% in August — the smallest increase since February 2021.The indexes for airline fares, used cars and trucks, and motor vehicle insurance all declined over the month — which isn’t surprising given the decrease in travel.

The data show that life has gotten more expensive over the past year due to the coronavirus pandemic’s halt on the supply chain and the way quarantine changed life and work. But the most important question retirees and hopeful retirees should ask themselves is — who will this impact the most?

Read More: How to Manage Inflation

Factors That Impact a Person’s Vulnerability to Inflation

While it’s clear that inflation is a threat, the people who should be most concerned are those without the flexibility needed to adapt.

The economy is undoubtedly changing, yet some people are more affected by it than others:

- Less than one-fourth (18.6%) of respondents in Personal Capital’s survey reported a reduction in their work hours.

- Even fewer were laid off (8%), lost their job but found work (6%), or lost their job but found part-time and/or freelance work (2%).

- Another small sampling (8%) stated their self-employment income decreased.

Meanwhile, over half (56%) of respondents did not experience a disruption in their job and income.

Inflation impacts each American differently. We didn’t sample whose jobs allowed the flexibility to work from home or provided additional support like home office stipends, but it’s easy to consider how a person who earns their income from home will be less impacted by gas prices (the most expensive cost spike) and have greater ability to save money for retirement.

And, of course, this leaves the commuters to shoulder most of the inflation burden.

Not to mention, there are certain costs that just cannot be trimmed any farther.

Those in the Personal Capital survey had a net worth of at least $100,000, and a median household net worth (excluding primary residence) of $422,066. Consider a family making the choice between generic brand groceries and free-range, organic chicken breast: They might need to re-work their grocery budget, but they still have the ability to shave off costs.

However, poorer Americans who are already stretched thin buying Great Value canned goods will find that there’s less and less wiggle room to save on weekly sales and with coupons. Americans in this boat will probably find that inflation hits them hardest.

The Bottom Line

Retirees and near-retirees are worried about inflation — even more so than other concerns like the rising cost of healthcare. The numbers show that retirees do have cause to be concerned — but only to the extent that they can’t control their spending and saving.

The majority of people who answered Personal Capital’s survey questions said their plan to retire in five years has remained the same, despite the cost of goods rising.

But at the same time, most boomers and people over 40 are tightening up their spending and putting more into their 401(k) plans and IRAs.

Beyond saving and investing more, some retirees might find themselves planning to work a little bit longer than they’d hoped.

The poll, conducted by Qualtrics in late June, surveyed a national sampling of 772 people aged 40 and older (median age 67) who are fully or partially retired or who are planning to retire within the next five years. They had a net worth of at least $100,000, and the median household net worth (excluding primary residence) was $422,066. The respondents were equally divided between men and women.

*Among respondents who say they’ll need a larger nest egg. †Respondents were asked to select all answers that apply.

Personal Capital compensates Megan DeMatteo (“Author”) for providing the content contained in this blog post. Compensation not to exceed $500.

Author is not a client of Personal Capital Advisors Corporation. The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk.

The value of your investment will fluctuate over time and you may gain or lose money.

Original Article